Australia’s #1

Streamline Your Properties with Advanced Property Management Software

Effortlessly Manage Properties, Tenants, Finances, and Compliance—All in One Place

Discover the ultimate property management software tailored for the Australian market. Designed for property owners, managers, and real estate agencies, our software empowers you to manage your portfolio with ease. From automating daily tasks to gaining actionable insights, our all-in-one property management software helps you save time, reduce costs, and improve efficiency.

- Easy Access

- Fast Server

- Security Guaranteed

Our Clients

Trusted by Over 10,000 Aussies

Join the thousands of property managers, landlords, and real estate professionals who rely on us to streamline their operations, improve efficiency, and deliver exceptional service.

About Us

Empowering Property Managers Across Australia

At Local Property Management Software, we’re redefining the way property management is done. Tailored for the unique needs of the Australian market, our platform simplifies property operations for landlords, real estate professionals, and property managers.

Our Features

Features That Make Local Property Management Software Stand Out

From streamlined operations to enhanced compliance, discover how our software empowers property managers across Australia.

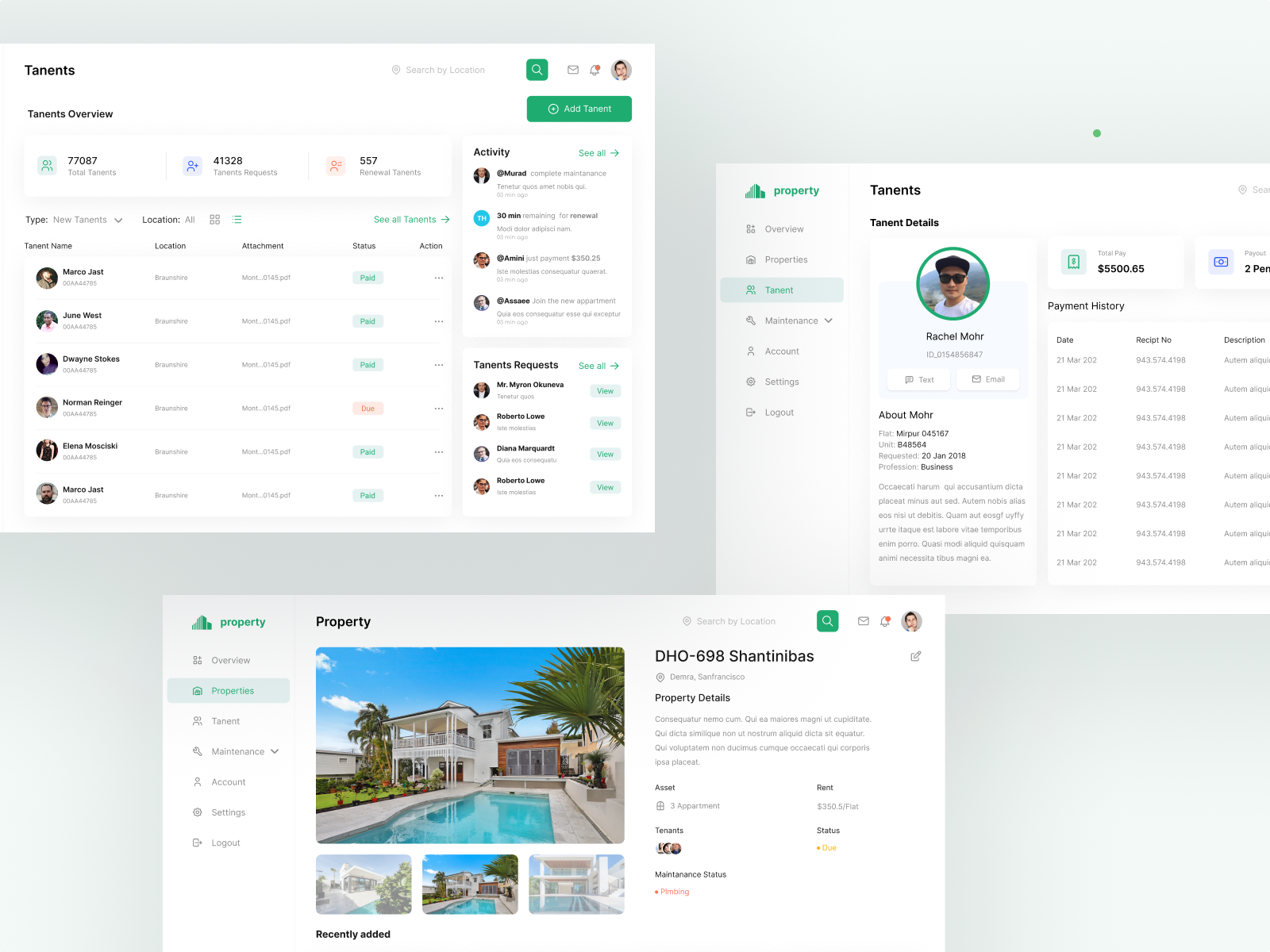

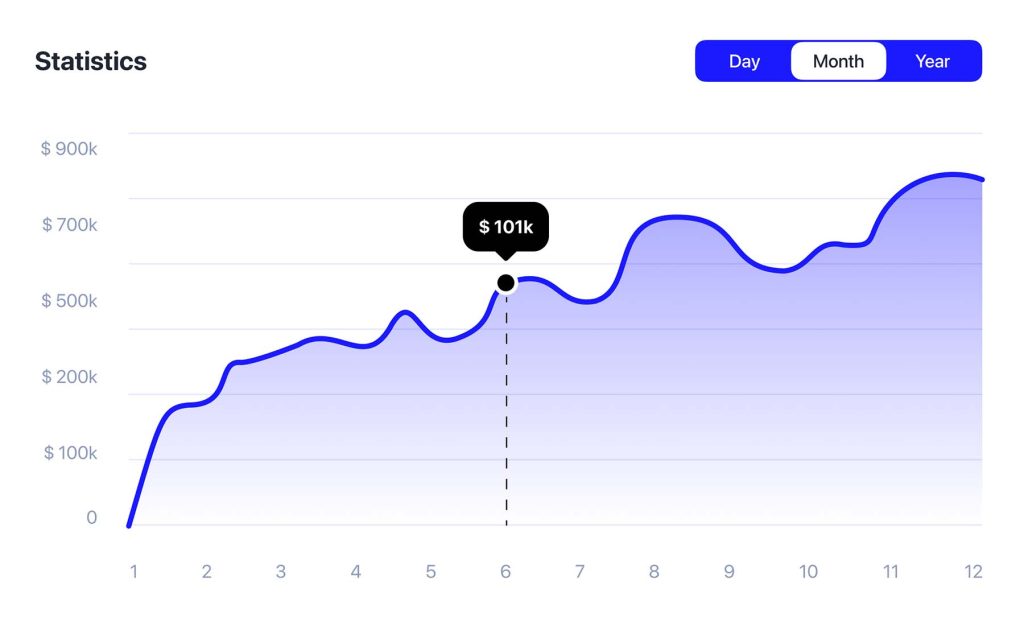

Centralised Dashboard

Our intuitive dashboard gives you a complete overview of your property portfolio at a glance. Access key metrics like occupancy rates, rental income, and upcoming tasks—all in one central location.

Automated Financial Management

Say goodbye to spreadsheets and manual calculations. With automated rent collection, expense tracking, and tax-ready reports, managing your finances has never been easier.

Streamlined Tenant Management

Keep track of tenant details, lease agreements, and rental histories with ease. Our software also enables automated notifications and payment tracking to ensure smooth communication and transactions.

How it works

Effortless property management in just a few simple steps.

Experience how simple property management can be.

01

Sign Up and Get Started

Create an account and customise the platform to suit your property portfolio. Start managing properties within minutes.

02

Add Properties and Tenants

Quickly input property details and tenant information. Our intuitive interface makes it easy to keep everything organised.

03

Automate and Streamline

Set up automated rent collection, reminders, and compliance tracking to save time and reduce manual work.

04

Monitor and Optimise

Access real-time insights and reports to stay on top of finances, maintenance, and occupancy rates—all from a central dashboard.

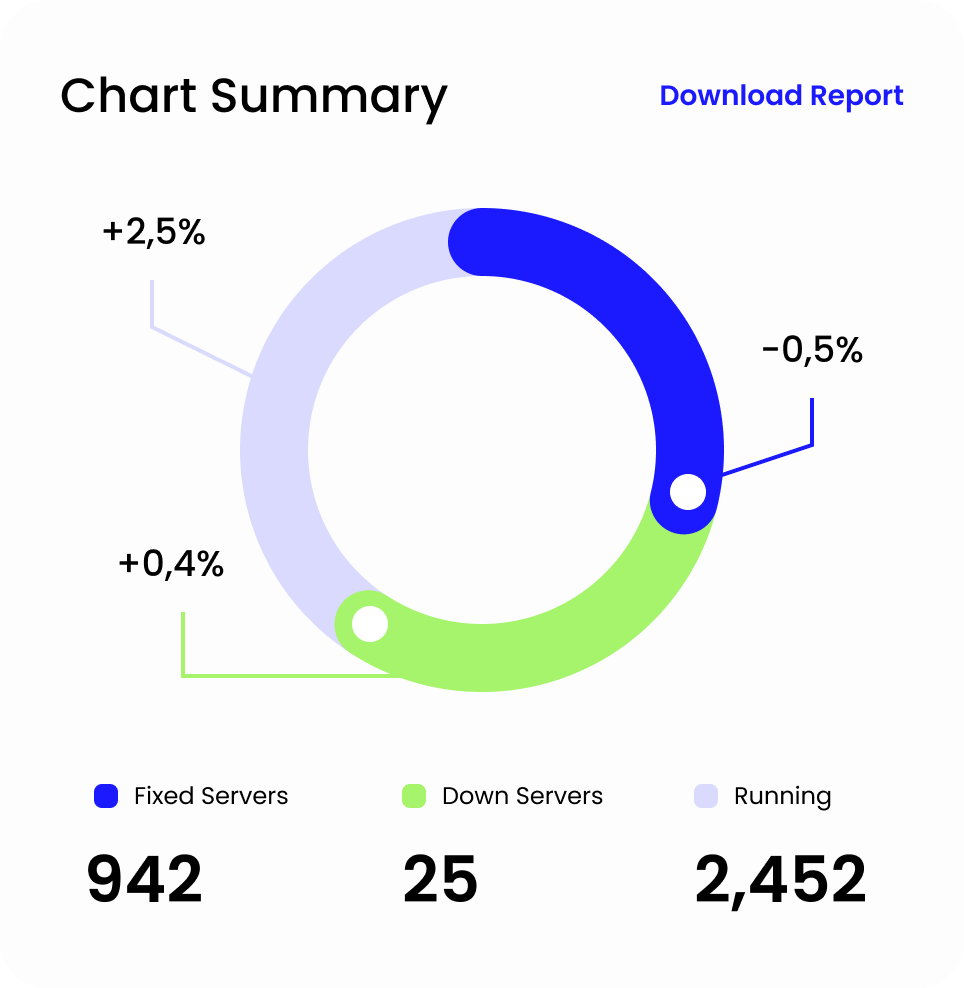

Our Numbers

Trusted by Thousands of Property Professionals Across Australia

Our impact speaks for itself. Here’s a glimpse of how Local Property Management Software is making a difference for landlords, property managers, and real estate professionals.

Testimonials

What Our Users Say About Us

Real feedback from property managers, landlords, and real estate professionals who trust us to simplify their work.

FAQs

Frequently Asked Questions

Blog News

Articles About SaaS

Let’s Try!

Start your 7-days free trial!

Ready to get started with your property management journey? Try 7 days free on us.

- Easy Access

- Fast Server

- Security Guaranteed